A contrarian indicator

The American Association of Individual Investors (AAII) is an organization dedicated to private investors that conducts weekly sentiment surveys to gauge market expectations. Participants respond to the question: “I feel that the direction of the stock market over the next six months will be:” with one of three choices—Up (Bullish), No Change (Neutral), or Down (Bearish).

Since its inception in 1987, the survey has shown an average sentiment breakdown of 37.7% Bullish, 31.3% Neutral, and 31% Bearish. This results in an average Bullish minus Bearish Sentiment Spread of +6.7%.

Using AAII Sentiment as a Market Indicator

The AAII sentiment data, combined with other technical indicators, can be a valuable tool for identifying market tops and bottoms. Investors can identify extremes in market sentiment by analyzing the Bull-Bear Spread and applying multiples of its standard deviation.

A Bull-Bear Spread reading below its historical average minus two standard deviations is rare. When such a reading occurs, it often signals that the market is near or at a bottom.

Yes, the AAII sentiment survey is a contrarian indicator. When individual investors are overwhelmingly bullish, it often serves as a sell signal, as historically, retail investors tend to be wrong at extremes. Conversely, when they are extremely bearish, it typically signals a buying opportunity—again, because they are usually wrong at these extremes.

Historical Precedents of Extreme Negative Sentiment

On February 25, 2025, the Bull-Bear Spread plunged to -41.2%, which is 2.6 standard deviations below its historical average—an extreme move. Since June 1987, sentiment has reached such depressed levels only three times.

1990 Bear Market Recovery

In 1990, there was a cluster where the Bull-Bear Spread remained below -41.2% for four weeks from late September to mid-November. During this period, the market remained near its lows, but when it rebounded in November, it launched a significant and sustained rally, as shown in the table below:

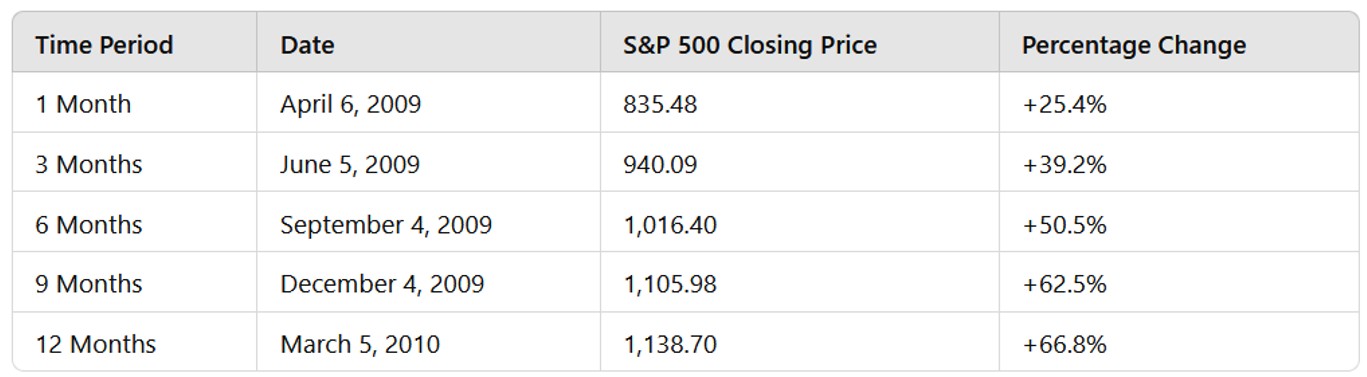

2009: The Great Recession Lows

On March 5, 2009, at the depths of the Great Recession bear market, the Bull-Bear Spread fell to -51.4%. Following this extreme bearish sentiment, the S&P 500 staged an impressive recovery, as illustrated in the table below.

2022: A Premature Sentiment Signal

More recently, in 2022, a similar cluster occurred, with the Bull-Bear Spread remaining below -41.2% for four weeks from April 28, 2022, to September 22, 2022. However, unlike in 1990 and 2009, this extreme bearish sentiment did not coincide perfectly with the market bottom. The S&P 500’s performance one year after these sentiment extremes was underwhelming. Nevertheless, the data suggests that by the time sentiment reached such negative levels, the downside risk in the market had already been largely exhausted, as you can see in the table below:

Key Takeaways

The 2022 episode highlights that extreme negative sentiment does not always pinpoint an immediate market bottom, nor does it guarantee a strong rally. However, history suggests that such levels of pessimism generally precede better-than-average S&P 500 performance.

More importantly, when AAII sentiment reaches extreme bearish readings, significant further declines in the S&P 500 become increasingly unlikely.

So what are the implications of the most recent reading? Subscribe to our Letter and you’ll see a vital chart and the specific forecast given the current situation which I show in the March 1st 2025 Letter.

Sincerely,

Manuel Blay

Editor of thedowtheory.com